Making Medicare Easy.

Speak with a Licensed Insurance Agent | 1-888-321-6361

What is Medicare?

Medicare is a federal health insurance program designed for only people who are 65 or older. People who are under 65 are not able to join Medicare unless they have been on Social Security disability for more than 24 months and have surpassed the waiting period for Medicare coverage. Additionally, people who can also benefit from this program are people with certain disabilities such as end-stage renal disease and other permanent disabilities.

Like Social Security, Medicare is an entitlement program that most U.S. citizens become eligible for by working and paying taxes for a minimum period of time, typically 40 quarters (10 years). As a result, most people join the Medicare program after turning 65 years old or retiring and leaving their group health insurance.

Parts Of Medicare Coverage

Medicare coverage has four parts: Part A, Part B, Part C, and Part D.

What is Medicare Part A? • Part A of Medicare is commonly known as hospitalization insurance. This part of Medicare primarily covers the cost of your time in the hospital (inpatient care), skilled nursing facility care, hospice care, home health care, and more.

What is Medicare Part B? • Medicare Part B helps cover the costs of your doctor’s visits and other outpatient services, including outpatient procedures, x-rays, lab tests, preventative services, and more.

What is Medicare Part C? • Medicare Part C plans, commonly known as “Medicare Advantage Plans,” are offered by private insurance carriers who have a contract with Medicare and are required to provide at least the same benefits as Original Medicare. You may enroll in a Part C Advantage plan to replace your “Original Medicare” (Part A and Part B) coverage.

What is Medicare Part D? • Medicare Part D, also known as your “Prescription Drug coverage,” is sold by private insurance companies and can vary in cost & by the drugs they cover. Part D drug plans are available to anyone enrolled in Medicare and are offered either as a stand-alone plan or built into a Medicare Advantage Plan.

What is Original Medicare?

Part A and Part B of Medicare provide the foundation for your Medicare coverage. When combined, these two parts of Medicare are known as “Original Medicare.“ Part A provides “hospitalization insurance,” which mostly assists with the cost of inpatient care. In contrast, Part B provides “medical insurance” for services, including doctor’s visits, outpatient procedures, x-rays, lab tests, and preventative services.

What Is Medicare Part A?

Medicare Part A is often referred to as your “hospital coverage” since it covers your care while in a hospital. This includes your semi-private room, your hospital bed, your meals while in the hospital, etc.

What Does Part A Cover?

- Skilled Nursing Facility Care

- Semi-Private Room

- Hospital Meals

- Lab Services

- Inpatient Care in Hospital

- Nursing Home Care (as long as custodial care is not the only care you need or long-term care)

- Hospice Care

- Home Health Care

- Assisted Living

What Is Medicare Part B?

Medicare Part B is also known as “medical insurance” since it covers several different outpatient medical services – both in and out of the hospital. This includes services such as doctors, x-rays, lab tests, flu shots, etc.

What Does Part B Cover?

- Outpatient Care

- Clinical Research

- One-Time “Welcome to Medicare” Wellness Exam

- Annual “Wellness” visit every 12 months

- Laboratory Tests – X-rays, blood work, etc.

- Ambulance Services

- Durable Medical Equipment (DME) – Wheelchairs, walkers, hospital beds, home oxygen equipment, etc.

- Prosthetics & Orthotics

- Mental Health Care

- Preventative Services

Medicare Part A Coverage Explained

Part A Deductible

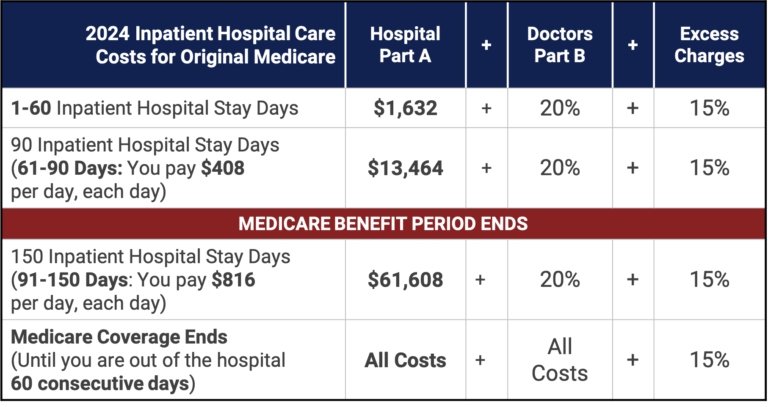

Any expenses you incur while an inpatient in the hospital would fall under Part A of Medicare. You will have to pay a $1,632 annual deductible in 2024 before your Medicare Part A hospitalization coverage begins. Additionally, if applicable, you will be responsible for some cost-sharing for extensive hospital days. See the chart below for the exact breakdown of costs:

Part A Cost-Sharing

Your Medicare Part A will cover a significant amount when it comes to costs; however, there will be some costs that you will be responsible for. Each year, CMS determines the Medicare Part A coinsurance and deductible that you will be responsible for during the following year. The chart to the right is the cost-sharing amounts you must pay when using your Part A benefits.

Medicare Part B Coverage Explained

Part B Cost-Sharing

After you met your annual deductible, Medicare pays 80% of any Part B-approved services. You are responsible for paying the remaining 20%. Medicare Part B covers your outpatient services, such as doctor visits, lab tests, x-rays, and other services listed above. One essential thing to remember is there is no cap on your out-of-pocket costs under Medicare Part B, which means if your total bill were $100,000, you would owe $20,000 or more as the bill rises. Medicare will deduct your Part B premiums from your Social Security check if you are already enrolled to receive your Social Security benefits. If not, they will bill you quarterly.

Part B Deductible

The Medicare Part B annual deductible for 2024 is $240. After you met your deductible, Medicare pays 80% of any Part B approved services. You are responsible for paying the remaining 20%. Medicare Part B covers the most frequently used services such as doctor visits, lab tests, x-rays, and other services received outside of the hospital. One very important thing to remember is there is no cap on your out-of-pocket costs under Medicare Part B, which means if your total bill was $100,000, you would owe $20,000 or more as the bill rises.

Medicare Hero Super Tip • Beware of Penalties!

If you fail to enroll in Medicare Part B during your enrollment window when you are first eligible to sign up, it’s important to know you will be subject to pay a late enrollment penalty. Your monthly premium may go up 10% for each 12-month period. This is because you should have had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

How Do I Apply For Original Medicare?

It’s important to know that Part A & B are the only parts of Medicare you will need to enroll in via the Social Security office.

If you are receiving Social Security benefits at least (4) months before your 65th birthday, you will be automatically enrolled into Medicare Part A and Part B. You should receive your red, white & blue Medicare card in the mail about approximately (3) months before your birth month.

If you are NOT receiving Social Security benefits, you will not be automatically enrolled and will need to enroll through the Social Security office when you turn 65. To learn more about enrollment, visit how to apply for Medicare.

Continue learning about Medicare in the next article: Medicare Costs

CONTACT

ADDRESS

14140 Midway Rd #150,

Dallas, TX 75244

PHONE

HOURS

MON – FRI: 8:30 AM – 6:00 PM

SAT – SUN: Closed