Making Medicare Easy.

Speak with a Licensed Insurance Agent | 1-888-321-6361

Medicare Supplement Plan F and Plan G go head to head as we discuss which of these two popular plans is really better!

Choosing the right Medicare Supplement plan (also referred to as Medigap Plans) can often be a confusing process. Our goal today is to help our readers gain some insight into the two most popular Medicare Supplement Plans available, Plan F and Plan G.

Click Here To Watch Our Video Review: Plan F vs Plan G

First, it is important to note that Plan F is currently being phased out and is not available to anyone who is new to Medicare after January 1st of 2020. Plan F is NOT going away though and will remain an available plan option to anyone who joined Medicare PRIOR TO January 1st 2020 cut off date. So if you currently have Plan F you can keep it and if you had Medicare coverage prior to the 2020 cut off date then you can still enroll in Plan F Today. This means that Plan G is now the highest level of Medicare Supplement coverage available today for those joining Medicare after the January 1st 2020 cut off date.

With that said, many people do not realize there is actually only ONE difference between Plans F and G: the Medicare Part B deductible of $203 which is not covered by Plan G.

Really that’s it! Same networks of doctors and hospitals and the same covered services. Plan G simply has a $203 deductible that you pay out of pocket each year where Plan F has no deductible.

Why do we recommend Plan G?

Lets use a real life example:

Shannon S.

Female

Single

Age 70

Dallas Texas

Zip Code: 75093

No Tobacco Use

Plan F monthly premium:$135

Plan G monthly premium: $107

Choosing the right Medicare Supplement plan (also referred to as Medigap Plans) can often be a confusing process. Our goal today is to help our readers gain some insight into the two most popular Medicare Supplement Plans available, Plan F and Plan G.

Click Here To Watch Our Video Review: Plan F vs Plan G

The first and most important aspect to to selecting a Supplement plan is understanding the difference between the two most popular plans. Many people do not realize there is ONLY ONE coverage difference between Plans F and G: the Medicare Part B deductible of $203 which is not covered by Plan G.

Really that’s it! Same networks of doctors and hospitals and the same covered services. Plan G simply has a $203 deductible that you pay out of pocket each year.

Save Money This Year!

In this very common scenario Shannon would save $336 in premiums each year with Plan G! Even after paying her deductible she would still save $133 per year for the exact same coverage!

So to turning the tables around in Shannon’s case if she were to select Supplement Plan F she would basically be paying here deductible up front (whether she used the doctor or not) PLUS a “Convenience Fee”, as I call it, of $133 each year.

But believe it or not this is the least important of the three reasons I recommend Plan G to all of my Medicare Clients!

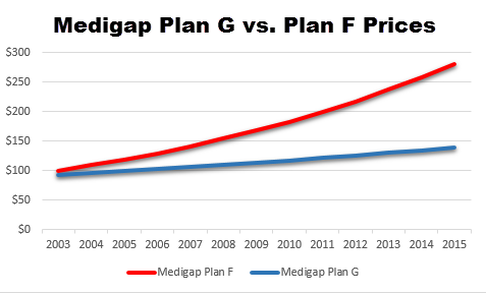

Plan G typically has lower rate increases

Average Yearly Rate Increases:

The next important aspect to Plan G is the lower rate increases it provides over Plan F. Historically Plan G has lower rate increases year to year then Plan F.

These lower rate increases are due in part to Plan G’s deductible. When Medicare supplement insurance plans include a deductible people are a little less likely to use the doctor at the beginning of the year any may instead opt to take an over the counter time rather then paying their deductible at their doctors office.

Medicare Changes 2020

Many People are not aware that Medicare Supplement Plan F is no longer available to be sold to new Medicare beneficiaries as of January 1st 2020. This means those who have Plan F will be able to keep their coverage but each year that passes the age of those with Plan F will rise inevitably along with the rate increases. As the rates of Plan F begin to increase those who are healthy enough to qualify for Plan G will like switch at that point to lower their premiums which will only serve to drive plan F rates even higher.

So why do we recommend Plan G?

Simply put a Medicare Supplement Plan G will save you money this year, provide you with historically lower rate increases next year, and will help you avoid any large rate increases that may come in future years as Plan F is phased out.

Resources

Get A Quote! Click HERE to find out how much each plan would cost for you.

Learn more about Medicare Supplement Plans by downloading your free copy of our Stress Free Guide To Medicare.

CONTACT

ADDRESS

14140 Midway Rd #150,

Dallas, TX 75244

PHONE

HOURS

MON – FRI: 8:30 AM – 6:00 PM

SAT – SUN: Closed